The Facebook IPO draws nearer, and we break down why it should matter (or not) to you.

The Facebook IPO has been looming on the horizon for some time now. Recent speculation has increased the ever-building hype around the company’s S1 filing, and the latest rumors say that the process could begin as soon as Wednesday. According to the Wall Street Journal, insiders suggest as much and say the company is expected to raise somewhere between $75 and $100 billion.

Beyond the fact that this means some very fortunate people are about to become very, very rich, what does the Facebook IPO mean?

For users

Largely, a Facebook IPO means very little for users. The site will continue to serve the same purpose: no one is going to entirely uproot and change the site’s direction, and none of the long-harbored Facebook fears are going to come true. This includes, but is not limited to, users being able to see who has visited their profile and being forced to pay for Facebook.

Of course the company’s structure will change, and there are competing opinions about what the trickle-down effect will be. Yes, the site will become beholden to shareholders, and that could mean a very different governing attitude. When you have to answer to these people more, the way you make decisions inevitably has to change.

At the same time, Facebook is going to come into a lot of cash, and that could mean everything from features everyone’s been holding out on (the Facebook phone, a fully-fledged, built-in media dashboard) to little things, like server upgrades to improve the back-end.

But it’s not like Facebook didn’t have investors to answer to before, or didn’t have enough money to scoop up small startups to its pleasing. It’s just that the degree of both of these things will increase.

Sure, there are concerns that new pressures put on the site could lead to a sacrifice for user experience, or that Facebook could be overrun by its shareholders and become stagnant. These are long-term consequences, though, and apply to every company that goes public. We’re going to call them unlikely based on Facebook’s dependence on users and the fact that it’s probably learned from its predecessors’ mistakes.

For shareholders and employees

Of course the real winners of a Facebook IPO are the company’s shareholders. Early investors like Peter Thiel and Sean Parker will be handsomely rewarded for their insight, and CEO Mark Zuckerberg obviously stands to rake in quite a bit of cash. If Facebook is able to raise the projected $100 billion, then Zuckerberg will go home with $25 billion.

When a company IPOs, there’s a sort of rearrangement that happens, and that means the Facebook team will see some shake-up. Employees are shareholders (to varying degrees, depending on their roles within the company), so they stand to make money off of this move. Some of them have been waiting until Facebook IPOs so they could take the money and pursue their own startup.

For the market

This infusion of Facebook talent back into the market has its own effects. All these very talented people who decide to take their plans and will infuse some new innovation and ideas into the market. We’ve already seen Facebook employees like Dustin Moskovitz (co-founder of Asana) and Adam D’Angelo (founder of Quora) part ways with their former job to strike out on their own, and now some new veterans from within the company – who have some nice, new money – will do the same.

Advertisers will likely see the price of the Facebook Ads service increase. Facebook will have revenue goals it must meet to keep shareholders happy, and an easy way to do this is via its advertising platform. They will probably also be trying to drive business to it, with new features and controls for users. Expect to see the Open Graph fill out as well.

Advertisers will likely see the price of the Facebook Ads service increase. Facebook will have revenue goals it must meet to keep shareholders happy, and an easy way to do this is via its advertising platform. They will probably also be trying to drive business to it, with new features and controls for users. Expect to see the Open Graph fill out as well.Let’s lump investors in with the market as well, since they are such a catalyst in its growth. Unfortunately, only an elite crowd will be able to get their hands on Facebook stock. If you’re interested in getting a piece prior to the IPO, unless you know someone with a share and they owe you a favor (on the scale of you once saved them from a burning building), you’re probably out of luck. We do advise checking out SecondMarket, where certain individuals can qualify as “accredited investors” and look for Facebook stock for sale. The odds still aren’t great, but it’s worth a shot. And after the fact, it will be trading so high and shares will go so fast that it will be hard for your average Joe to be a part of it all.

This system of successful companies going public later and later is what’s contributed to this: lots of popular and big startups would IPO earlier, and the public would be a part of their growth, and more hands were in the investment pot.

And this cycle very well could continue: Facebook has set something of a precedent for the social startup, and its IPO process is going to be envied by new companies.

For California

Last but not least, Facebook’s home of California would profit from its IPO. Capital gains taxes (which is when stock sales are taxed) would translate to millions of dollars for the state. “In the coming months, the state’s revenue forecast will need to be adjusted somewhat to account for the possibility of hundreds of millions of dollars of additional revenues related to the Facebook IPO,” analyst Mac Taylor said regarding California’s budget proposal.

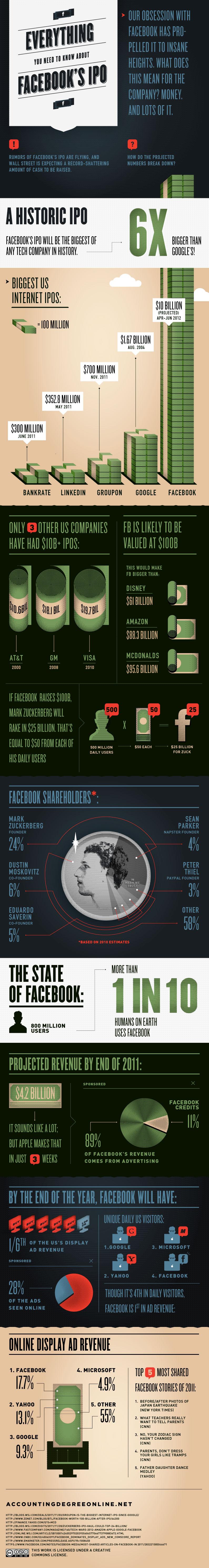

To put some of that into visual context, check out this infographic from AccountingDegreeOnline.

EmoticonEmoticon